Trend Dragon EA V13.0 MT5 – Free Trend Trading Bot

You know what’s annoying? Paying $100–$500 for a “premium” robot, installing it, and then realizing it’s basically a couple of indicators glued together with hype. Been there, seen that… and it wastes time, not just money. If you’re tired of overpriced robots and you just want a free MT5 setup that tries to catch trends cleanly (without you babysitting charts all day), this one’s for you.

Trend Dragon EA V13.0 MT5 is built around trend detection + automatic execution, designed for traders who prefer structured entries and consistent trade management rather than random button-clicking. It’s the kind of tool you load, test, tweak a little, and then let it run with rules. No miracles, no “guaranteed 10% daily” nonsense—just an automated approach that aims to participate when the market is actually moving.

Minimum deposit you shared is $500, which is honestly a sensible base if you’re planning to run an EA with real spreads, real slippage, real-world conditions… coz demo-only dreams don’t pay bills.

Overview

At its core, Trend Dragon EA V13.0 MT5 is a trend-following MT5 expert advisor: it waits for directional confirmation, then executes trades with pre-defined logic and trade management rules. In many public discussions of Trend Dragon, traders describe a proprietary trend signal (sometimes paired with Fibonacci-style decision zones) and an optional dashboard-like control style, meaning it can run fully automated or semi-auto depending on how you configure it.

Now here’s the important part: since brokers, symbols, and volatility differ, you should treat the EA like a system you validate—NOT a magic file. That’s why YoForex-style releases on MQL5.software usually push the same discipline: backtest → forward test → go live small → scale only after stability. You’ll see this approach repeated across multiple tools on MQL5.software, especially trend systems and multi-pair EAs.

Pair & Timeframe (what to use?)

You left Pair and Timeframe as “?”, so here’s the practical guidance most trend EAs follow:

- Pairs: Start with liquid majors (EURUSD, GBPUSD, USDJPY) and only add more pairs once you understand behavior. This is also a common setup recommendation across MT5 EAs because majors are usually cleaner + cheaper to trade (spread-wise).

- Timeframes: Trend logic generally behaves better on M15–H1 (less noise than M1/M5). If you want fewer trades and cleaner moves, H1 is a comfy place to start.

If Trend Dragon comes with setfiles/presets, follow those first—then optimize slowly. Don’t do 50 changes in one night and wonder why results got weird, lol.

Key Features

Key Features

Here’s what traders usually want from a trend bot, and what you should focus on when configuring Trend Dragon EA V13.0 MT5:

- Trend-first entries designed to avoid chop and focus on directional moves

- Fully automated execution (with potential semi-auto workflow depending on settings/UI)

- Risk controls you can tune (fixed lot or balance-based sizing)

- Trade management logic (TP/SL behavior depends on your configuration and broker conditions)

- Session control (run only London/NY if you want cleaner volatility windows)

- Works best on low-spread accounts (RAW/ECN style is ideal for most EAs)

- Can be tested across multiple pairs, but recommended to start with 1–2 pairs first

- Backtest-friendly workflow: Strategy Tester → tick data → forward test on demo

- Adjustable filters (trend strength, volatility, “avoid bad zones” style logic—varies by build)

- Scalable approach: begin conservative, then increase risk only after consistent weeks

- Designed for MT5 fast execution environment (better fills vs older terminals, generally)

Small note: some community write-ups mention martingale/hedging styles in certain Trend Dragon distributions. If your build includes recovery options, treat them carefully—disable anything you don’t fully understand, and keep risk tight.

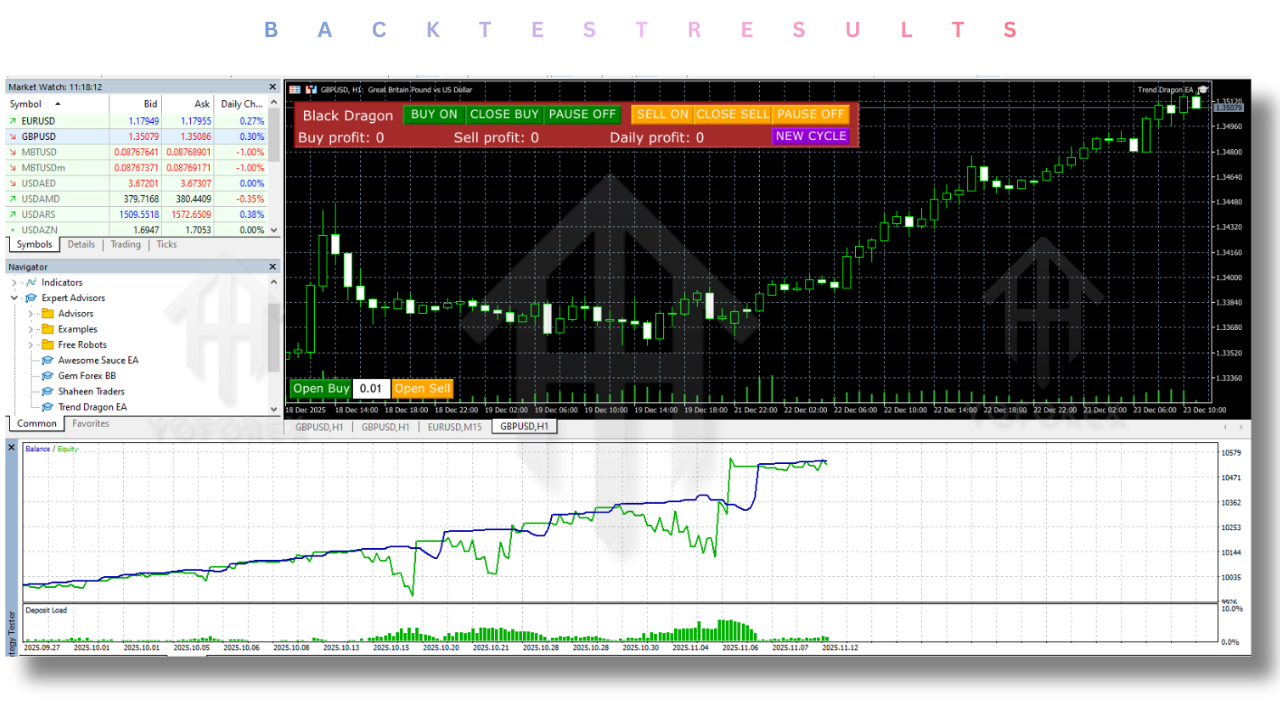

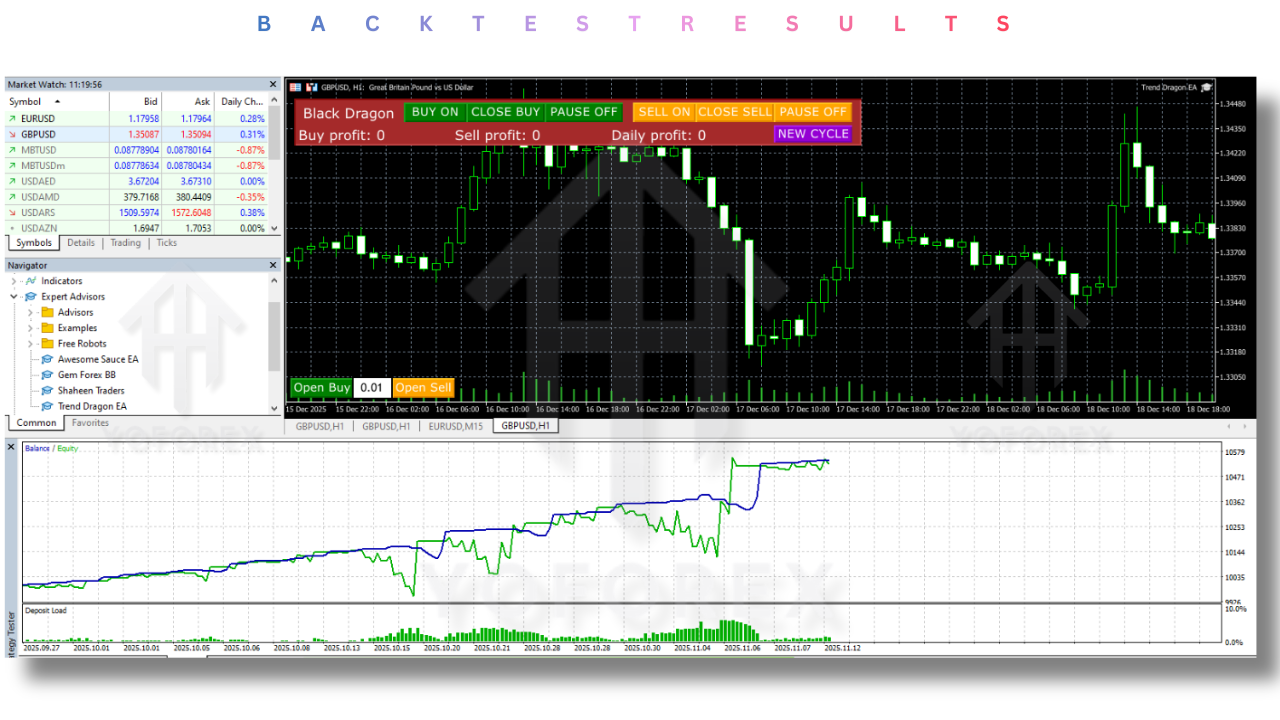

Backtest Results

Let’s be real: without your exact broker data and setfile, I can’t claim “X% profit” honestly (and you shouldn’t either). What is useful is how to present Trend Dragon’s backtest proof in a way that looks professional and actually helps readers.

What to include in your backtest section

When you run the MT5 Strategy Tester, aim to report:

- Testing period: at least 6–24 months (more is better)

- Model: “Every tick based on real ticks” if available

- Pairs tested: 1–3 max (don’t overfit 15 pairs)

- Spread & commission: set realistically

- Max drawdown: readers care about this more than profit

- Trade distribution: does it win small and lose big? That’s a red flag.

How the “equity curve story” should read

A good Trend Dragon curve usually looks like:

- steady upward slope during trending phases

- flatter periods in sideways ranges

- controlled pullbacks (not cliff-drops)

If you see long flatlines then one giant recovery basket… that’s usually a recovery system doing heavy lifting, and you should disclose that clearly.

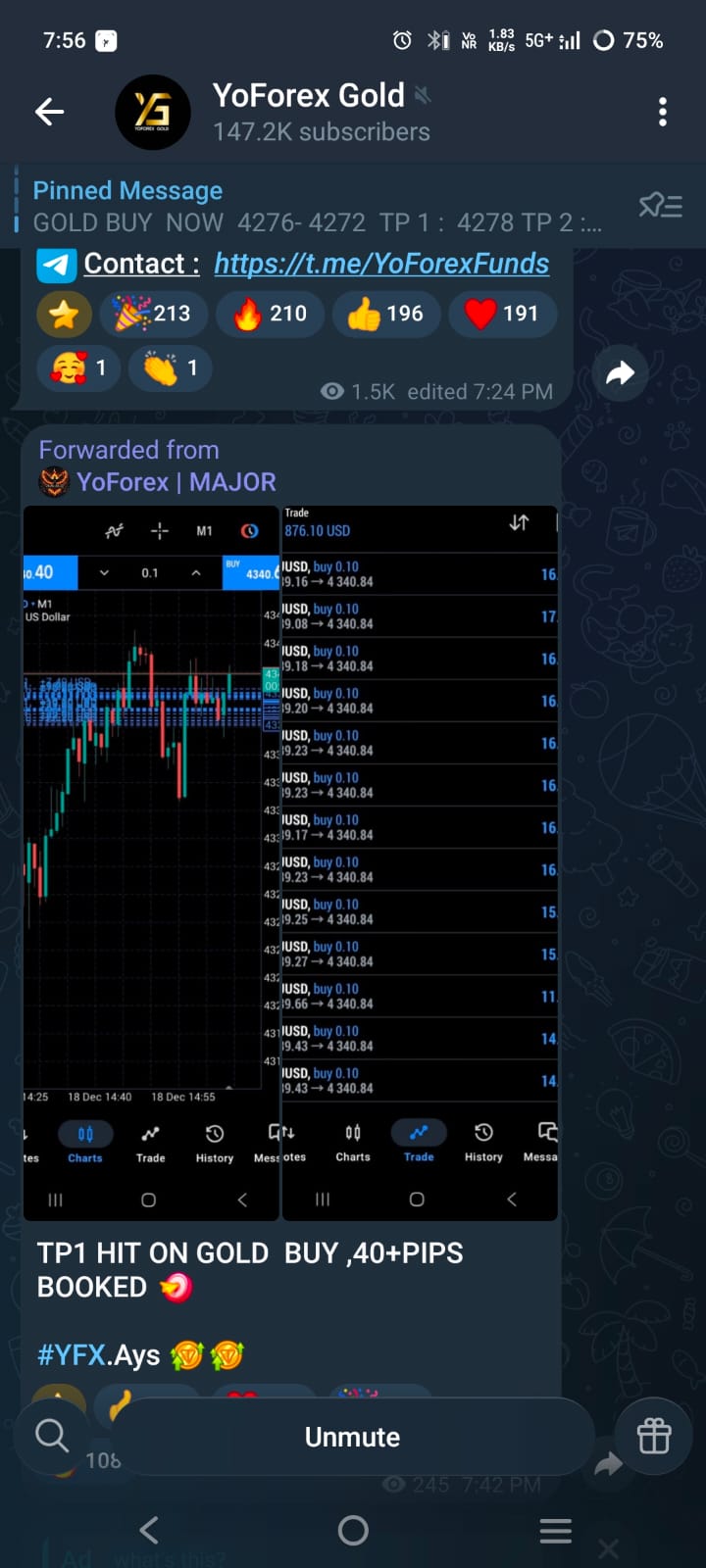

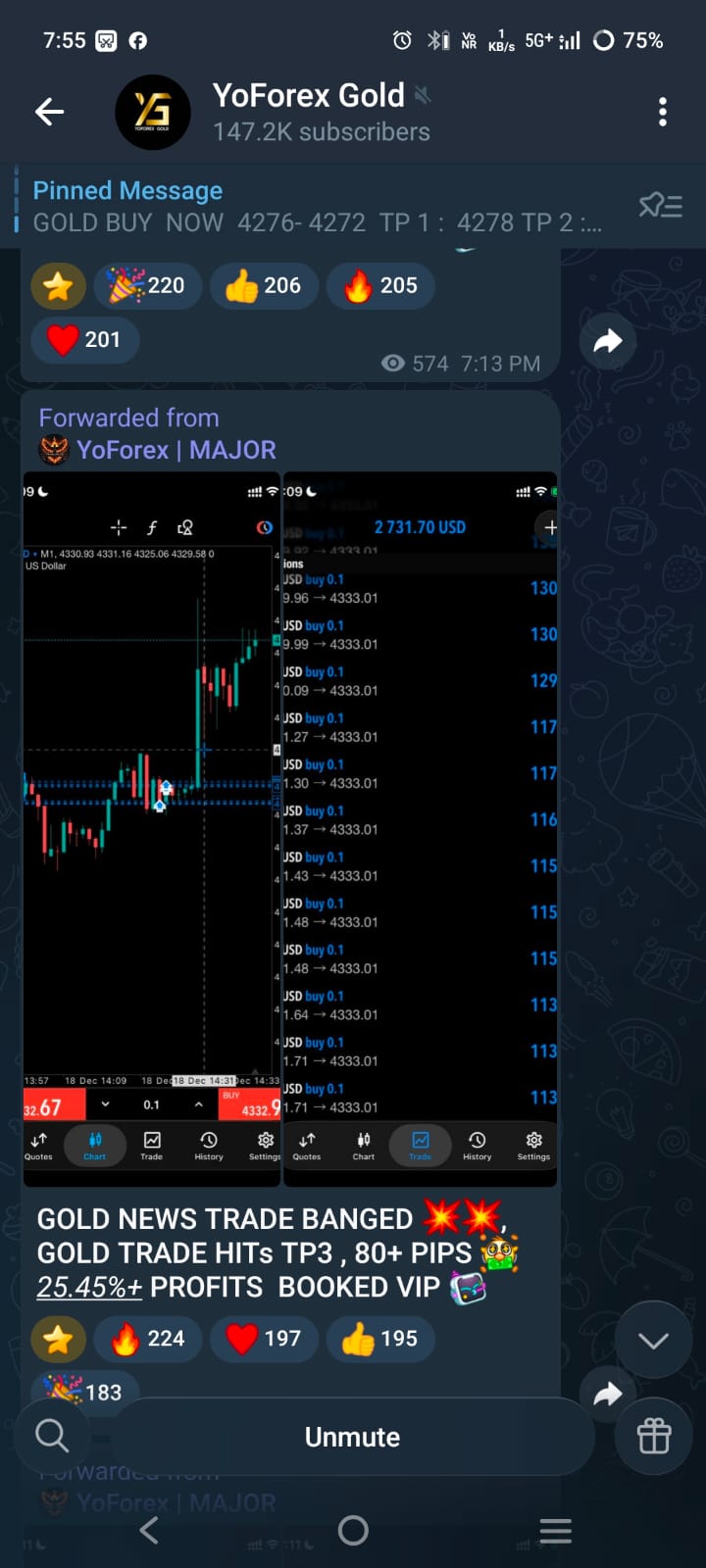

Live-market performance summary (what to say)

Keep it honest and simple:

- Mention you recommend demo forward testing first

- Mention results vary by broker/spread/slippage

- Mention the EA is best when markets trend and can slow down in ranges (normal for trend systems)

How to Install & Configure

How to Install & Configure

This part should be dead simple in your blog because most users mess up here.

Step-by-step install (MT5)

- Download the EA file from MQL5.software (or your post’s download section).

- Open MetaTrader 5 → File → Open Data Folder

- Go to MQL5 → Experts

- Paste the EA file (

.ex5) inside Experts - Restart MT5 (or right-click Navigator and refresh)

- Drag the EA onto the chart

- Enable Algo Trading (top bar) + tick Allow Algo Trading in EA settings

This is the same general MT5 install flow used across many MQL5.software EA releases.

Recommended starting configuration (safe-ish)

- Start on one pair only

- Use conservative lot sizing (especially on a $500 account)

- Avoid running during major news if you notice spikes hurt the strategy

- VPS recommended if your PC sleeps or disconnects often

If you want your blog to look premium, add a short “Settings checklist” under this section and include the screenshot of Inputs panel.

Why Choose YoForex-Powered Tools?

The biggest edge isn’t “secret code.” It’s consistency: updates, support, and a systemized way to test. That’s what YoForex tries to keep pushing through the free tools ecosystem—publish, test, improve, repeat. You’ll notice a lot of YoForex-style posts on MQL5.software emphasize simple onboarding + practical setup steps rather than fantasy ROI claims.

Also, when users get stuck (installation, DLL permissions, missing trades, wrong symbol suffix), having direct support on WhatsApp/Telegram saves hours. That alone makes these free releases more usable than random re-uploads.

Support & Contact

If you hit any bug, need help installing, or want a clean recommended setup for your broker conditions, ping the support channels:

- WhatsApp support: https://wa.me/+443300272265

- Telegram group: https://t.me/yoforexrobot

Disclaimer (keep this in your post):

Past performance is not a guarantee of future results. Trading involves risk. Always test on a demo account first, then trade small before scaling. Use proper risk management and never trade money you can’t afford to lose.

Call to Action

If you’ve been looking for a trend-focused EA you can actually test properly—grab Trend Dragon EA V13.0 MT5, set it up on one clean pair, and forward-test it for a couple weeks. Keep it simple, don’t over-optimize, and you’ll learn fast whether it matches your style.

YoForex – empowering traders worldwide, one free tool at a time.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment