Atlas Quant EA V1.0 MT4 – A Complete Beginner-Friendly Review and Setup Guide

Atlas Quant EA V1.0 MT4 is one of the newer algorithmic trading systems designed for MetaTrader 4 traders who want simple, controlled, and rule-based automated trading. With the rapid adoption of Expert Advisors in the forex market, many traders now look for EAs that are stable, consistent, and adaptable to real market volatility. Atlas Quant EA is built to fill that exact gap. It provides a clean quantitative model, clear rules, disciplined risk filters, and technically strong entries designed for trending and volatile conditions.

This extensive review on MQL5.software gives beginners a clear overview of how Atlas Quant EA functions, what makes it different, its trading logic, setup instructions, performance behavior, recommended settings, and how to get the best results from it. The article is intentionally written in a beginner-friendly language while keeping the depth required for serious traders.

Understanding Atlas Quant EA V1.0 MT4

Atlas Quant EA V1.0 MT4 is a fully automated Expert Advisor built using quantitative modeling principles. Instead of relying heavily on traditional indicators or visually interpreted chart patterns, the EA operates through structured logic, volatility assessments, and trend-based algorithms that run consistently without emotional interference.

The core idea behind Atlas Quant is simple: identify market imbalance early, enter during structured directional moves, control risk strictly, and exit with calculated precision. It does not chase the market, does not use dangerous techniques like martingale, and does not overload the account with excessive trades. This makes it suitable even for new traders who want a clean, disciplined trading solution.

Since this EA is based on version 1.0, it presents a modern approach to trading that fits the evolving volatility of 2024–2025 markets. Many older robots fail during uncertain conditions, but Atlas Quant aims to stay adaptive due to its reliance on real-time volatility readings instead of static triggers.

Key Characteristics of Atlas Quant EA V1.0

1. Quantitative Trading Logic

The EA evaluates price using a rules-based system similar to quant trading models. Instead of interpreting discretionary setups, Atlas Quant follows a structured algorithm that looks for trend expansion, volatility breakouts, and momentum-supported entries.

This ensures that trades are logical, consistent, and based purely on market behavior.

2. No High-Risk Money Management

Atlas Quant does not use:

- Martingale

- Lot multipliers

- Wide grid systems

- Reverse hedging

This avoids the type of catastrophic drawdowns that destroy many trading accounts. The EA uses fixed or percentage-based risk settings, which helps maintain stable long-term performance.

3. Dynamic Risk Filters

The EA adjusts its stop-loss and trade parameters based on market volatility:

- Tight stop-loss in quiet markets

- Flexible stop-loss when volatility expands

- Smart trailing stop logic

This dynamic model helps the EA survive both calm and aggressive market movements.

4. Multi-Asset Support

Although optimized for major forex pairs, Atlas Quant EA works on:

- EURUSD

- GBPUSD

- XAUUSD

- USDJPY

- AUDUSD

- Silver and CFD pairs (cautious mode required)

Its ability to adapt across different asset classes makes it useful for diversified trading.

5. Lightweight and Beginner-Friendly

The EA is not resource-heavy. It runs smoothly on almost any MT4 setup and functions perfectly with standard VPS services. Beginners who are new to Expert Advisors will appreciate its simplicity during installation and configuration.

How Atlas Quant EA Trades: Strategy Breakdown

Atlas Quant EA uses a rules-driven entry model based on market structure and volatility. Here is a simplified view of the strategy components.

1. Trend Identification

The EA first determines whether the market is trending or consolidating. It avoids entries during noisy sideways conditions to reduce false signals.

2. Breakout and Momentum Confirmation

Once a directional shift is confirmed, the EA looks for momentum alignment before executing a trade. This reduces the chance of premature entries and ensures trades follow sustained price direction.

3. Volatility-Based Entry Filters

The EA checks for volatility expansion to determine the strength of the move. When volatility is low, the EA stays inactive. When expansion occurs, the EA takes advantage of it.

4. Smart Exit System

The EA uses dynamic stop-loss and trailing stop adjustments. Instead of holding trades blindly, it reacts to changing market behavior and manages exits intelligently.

5. Strict Risk Allocation

Each trade is capped with a controlled risk percentage. This ensures stable equity growth without random large losses.

Who Should Use Atlas Quant EA?

Atlas Quant EA V1.0 MT4 is suitable for various trader profiles:

1. Beginners Learning Automated Trading

Due to its simple configuration and clean logic, beginners can understand how it works without advanced technical knowledge.

2. Traders Avoiding High-Risk EAs

Anyone concerned about martingale, grid trading, or over-trading will appreciate its disciplined model.

3. Trend Traders

If you trade trending pairs or enjoy breakout-style behaviors, this EA aligns well with your approach.

4. Gold Traders

The EA has strong compatibility with XAUUSD, making it appealing for traders who prefer metal markets.

5. Part-Time Traders

Users who do not want to watch charts all day can rely on the EA to operate automatically.

Installation Guide for Atlas Quant EA V1.0 MT4

Follow these steps to install and run the EA properly:

Step 1: Download the EA File

Save the .ex4 file to your computer.

Step 2: Open MT4 Data Folder

Inside MT4, click:

File → Open Data Folder

Step 3: Move the File

Navigate to:

MQL4 → Experts

Paste the EA file here.

Step 4: Restart MT4

Step 5: Enable Auto Trading

Click AutoTrading so the button turns active.

Step 6: Attach the EA

Open a chart → Drag and drop the EA onto the window.

Step 7: Configure Settings

Set:

- Lot size or % risk

- Stop-loss logic

- Trailing stop rules

- Spread filters

- Trading hours

- Step 8: Keep Terminal Running

Use a VPS to maintain 24/5 uptime for the best results.

Recommended Settings for Best Performance

Minimum Deposit

- Forex pairs: $200–$300

- Gold pairs: $500+

Best Timeframes

- M30

- H1

- Optional H4 for safer long-term trading

Suitable Leverage

- 1:500 recommended

- Minimum 1:200

Best Trading Pairs

- EURUSD

- GBPUSD

- USDJPY

- XAUUSD

Broker Conditions

- ECN recommended

- Tight spreads

- Low slippage

These settings ensure stable execution and optimized behavior.

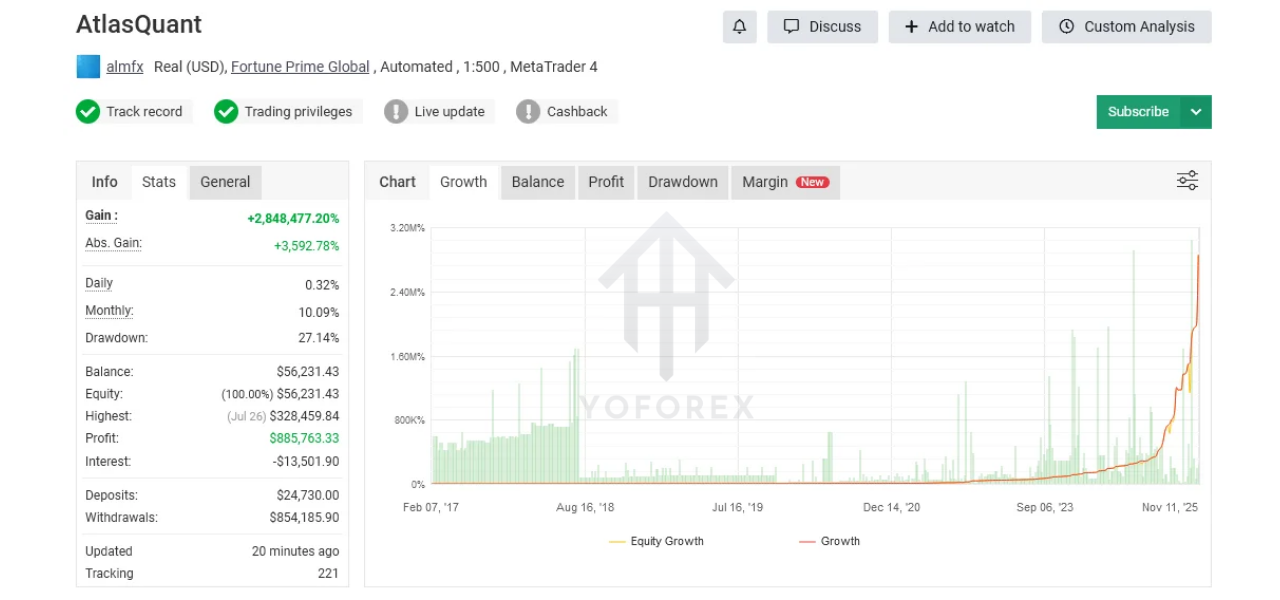

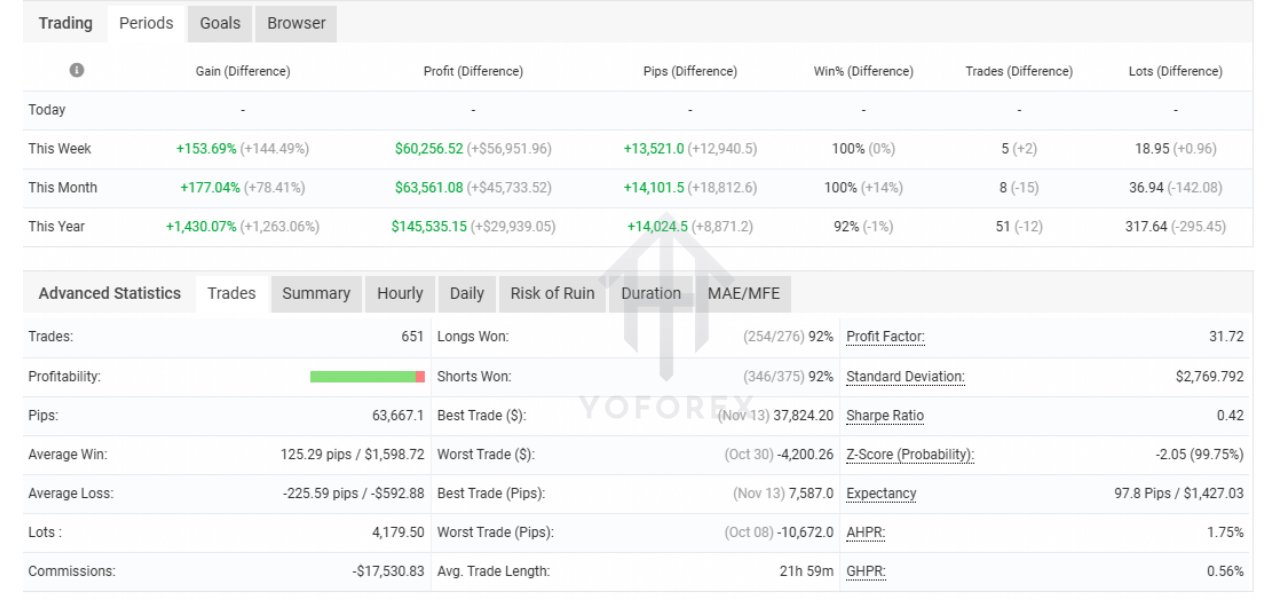

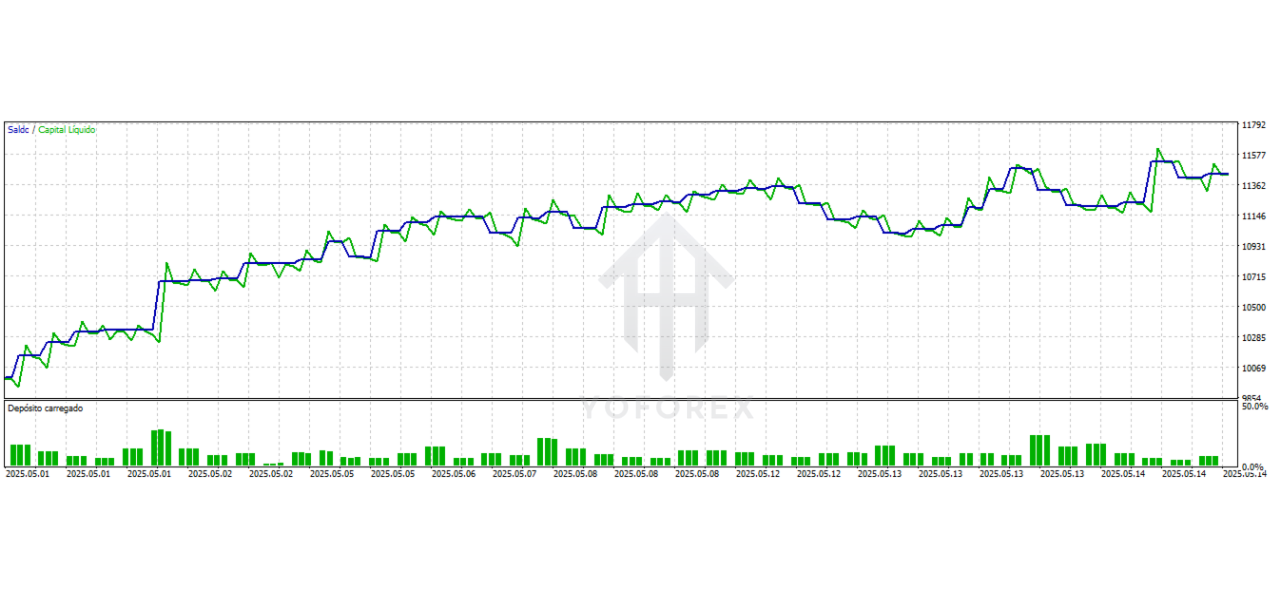

Performance Behavior and Long-Term View

Since Atlas Quant EA V1.0 is a recent release, long-term public records remain limited. However, the trading style suggests that traders can expect:

Strengths

- Good performance during clear trends

- Strong entries during volatility expansion

- Stable stop-loss behavior

- Avoidance of high-risk money management

Possible Limitations

- Fewer trades during quiet market weeks

- Reduced accuracy during choppy ranges

- Requires a VPS for best consistency

The EA is designed for long-term use, not aggressive short-term flipping. With proper risk control, it can fit well inside a structured trading portfolio.

Support

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Final Verdict

Atlas Quant EA V1.0 MT4 is a disciplined, modern trading robot built for traders seeking consistent, well-structured automated performance. It avoids dangerous risk methods, uses volatility-based logic, and performs strongly during trending phases. For beginners and experienced traders alike, this EA offers a stable, straightforward, and realistic way to experience quantitative-style trading on MT4.

If you prefer an EA that operates with clarity and controlled risk while remaining easy to set up, Atlas Quant EA V1.0 MT4 is a valuable addition to your trading tools. Testing it first on a demo account, then scaling responsibly, is the best way to unlock its full potential.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment