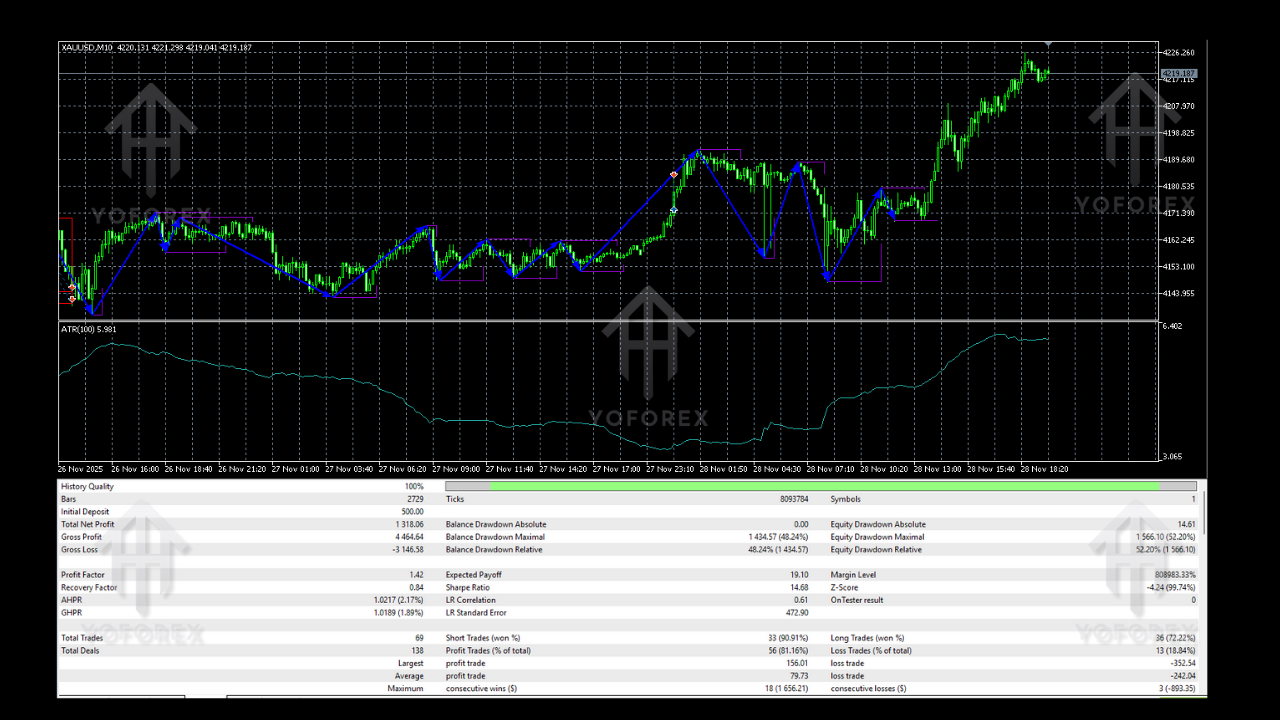

Gold BO ATR EA V2.0 MT5 Review: A Structured ATR-Based Approach to Gold Trading

Gold trading continues to attract traders for its strong market movement and consistent liquidity. XAUUSD provides daily opportunities, but it also brings high levels of volatility that often challenge manual decision-making. Many traders find themselves reacting emotionally, entering too late, or placing protective stops that do not adapt to the market’s behavior. This is where automation becomes valuable. A properly engineered Expert Advisor can eliminate emotional influence, improve consistency, and handle volatility with a predefined set of rules.

Gold BO ATR EA V2.0 MT5 is a system created for traders who want a disciplined and volatility-responsive approach to gold trading. It uses ATR-based calculations to adjust stop loss and take profit distances dynamically. Instead of relying on fixed levels that may be too tight during volatile periods or too wide during calm sessions, the EA adapts to market conditions instantly. This makes it a reliable choice for traders who want smoother, structured performance in XAUUSD.

Why Gold Requires a Different Type of EA

Gold is not like typical currency pairs. It moves quickly, responds instantly to market news, and often forms false breakouts intended to remove liquidity before continuing its direction. Traditional EAs built for forex pairs frequently fail on gold because they are not designed to manage such rapid changes. Gold requires a system that understands and responds to volatility in real time. ATR is one of the most reliable tools for this purpose.

Gold BO ATR EA V2.0 MT5 uses this volatility measurement to determine risk parameters automatically. When volatility expands, the EA widens its stop loss and take profit levels. When the market becomes quieter, the EA tightens them. This ensures that trades are not prematurely stopped out or kept open longer than necessary. Such dynamic behavior is essential for building a stable long-term gold trading system.

Core Trading Logic of Gold BO ATR EA V2.0 MT5

The EA operates using a structured sequence of analytical steps. These steps form the foundation of how the system identifies and executes trades.

Breakout Recognition

The EA seeks breakouts around key price levels. Breakouts usually indicate a shift in market structure or the beginning of a new direction. Rather than entering impulsively, the EA waits for confirmed breakout conditions based on momentum and filtered volatility.

Retracement-Based Entry Logic

After identifying a breakout, the EA does not immediately take a position. Instead, it waits for a retracement or pullback. This reduces the likelihood of entering during a false breakout and helps position trades at a more favorable price level.

ATR-Driven Stop Loss and Take Profit

ATR defines the distance of stop loss and take profit levels. This is a central and defining feature of the EA. Because gold moves differently throughout the trading day, this dynamic risk adjustment plays a major role in stabilizing the strategy.

Trend and Momentum Alignment

The EA checks whether the trade aligns with the current trend direction. This alignment reduces counter-trend entries and improves overall consistency.

Controlled Risk Parameters

The EA does not use martingale, grid strategies, or trade stacking. Every trade has a clear and pre-defined risk amount, making it suitable for long-term usage.

Key Features of Gold BO ATR EA V2.0 MT5

Dynamic Risk Management Using ATR

The adaptive ATR calculations make the EA significantly more flexible in volatile environments. This reduces stop-out frequency and helps increase trade longevity.

Breakout and Pullback Combination

The EA relies on structural price behavior. Breakouts provide directional confirmation, while pullbacks offer more accurate entry positions.

No High-Risk Trading Techniques

Many EAs rely on doubling positions or increasing exposure to recover losses. This EA avoids such techniques and focuses on clean, controlled trading.

Purpose-Built for XAUUSD

The EA is optimized exclusively for gold rather than attempting to cover multiple pairs with one logic system.

Easy Setup for All Users

The installation and setup process is simple. New traders can follow a basic application method without adjusting complex parameters.

Trade Filtering During Unstable Sessions

The EA is programmed to avoid trading during periods when market behavior becomes unpredictable or unsuitable for entry.

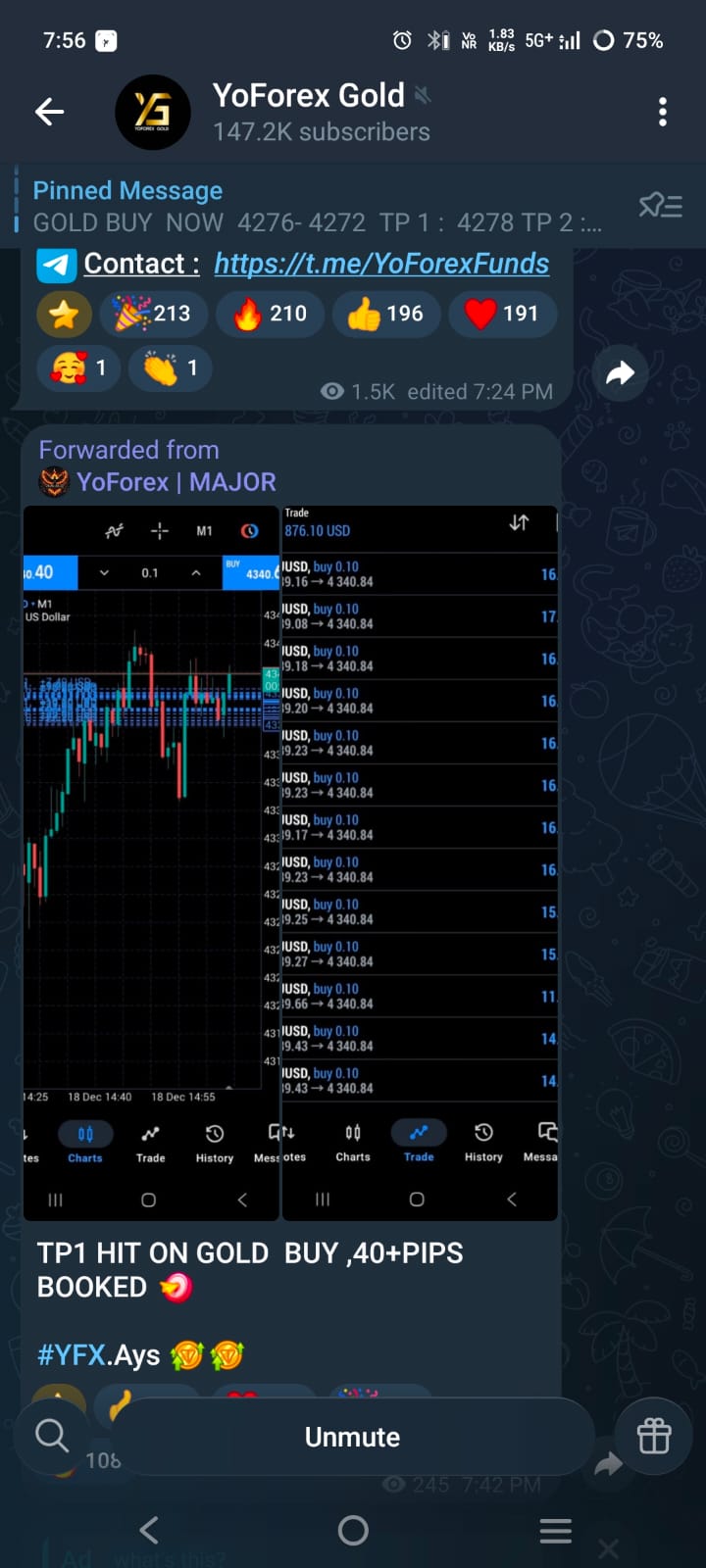

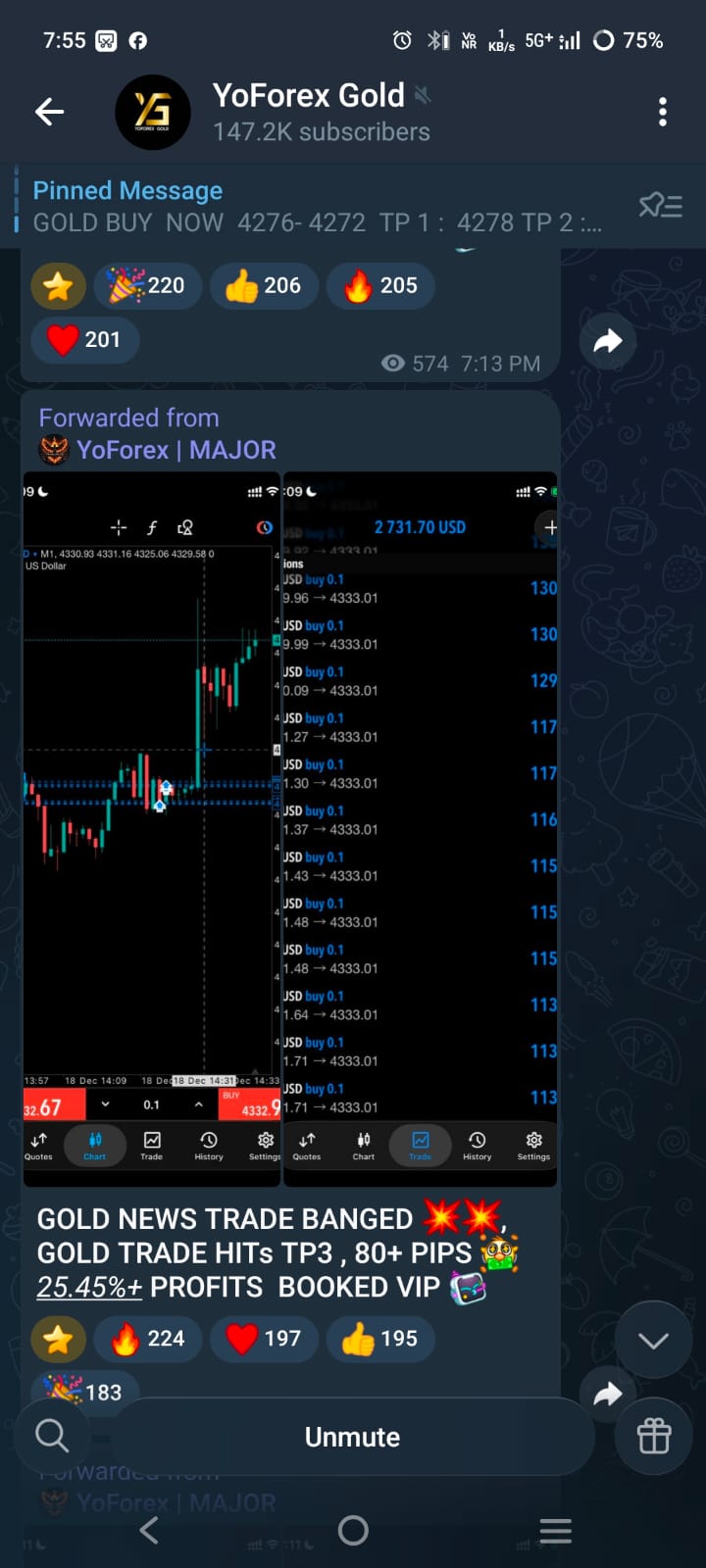

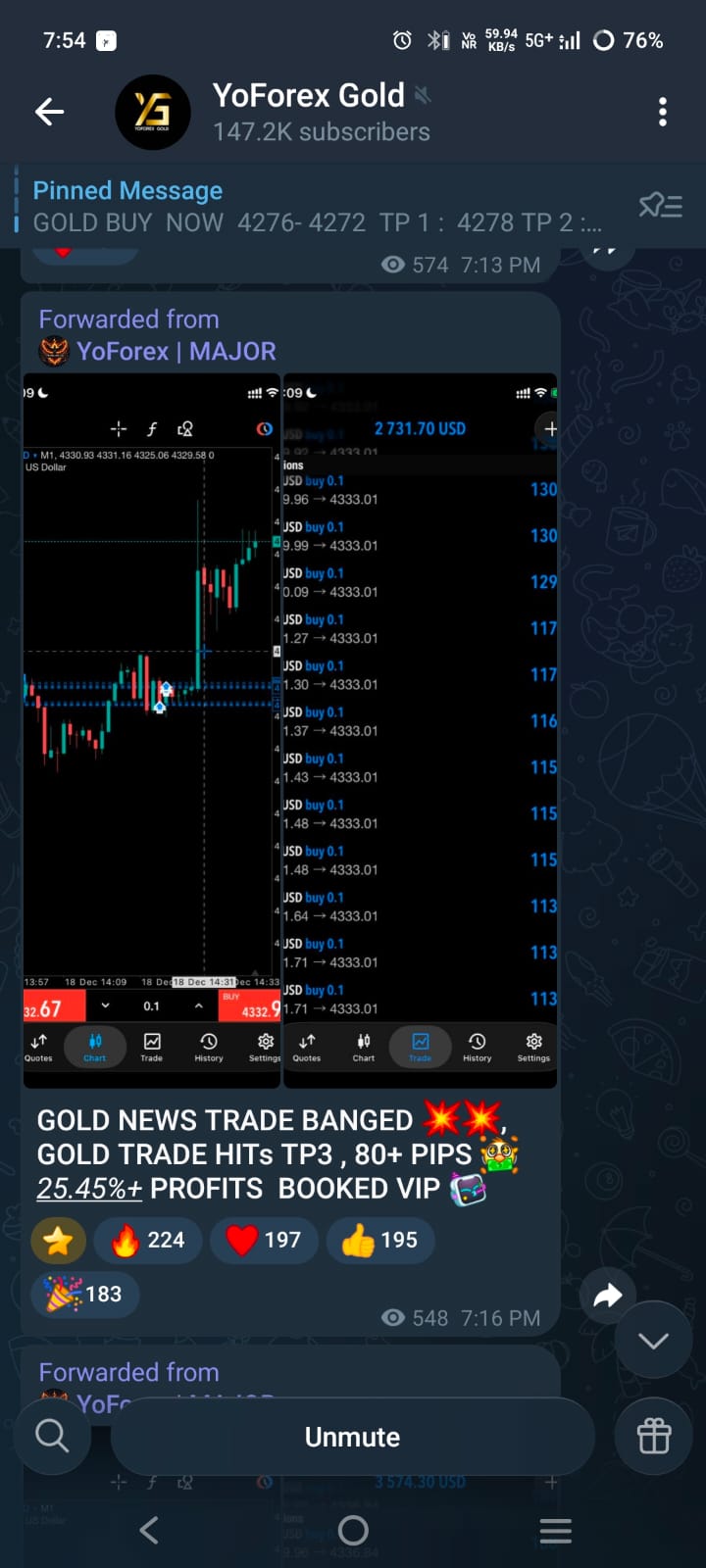

How the EA Performs in Live Market Conditions

Although performance can vary depending on the trading environment, certain characteristics remain consistent:

Strong in Trend-Based Environments

Gold often forms powerful movements, and the EA is equipped to capture these through its breakout structure.

Stable Performance During Volatility Shifts

ATR-based stop loss management helps the EA survive sudden expansions or contractions in volatility.

Minimal Overtrading

The EA does not enter frequently unless the conditions align with its parameters. This prevents unnecessary exposure.

Controlled Drawdown

Because the EA uses fixed risk and avoids martingale techniques, drawdowns remain more manageable compared to many aggressive systems.

Ideal Setup Conditions for Gold BO ATR EA V2.0 MT5

To ensure optimal results, traders should consider:

- Using an ECN or Raw Spread account

- Running the EA on a stable VPS

- Selecting timeframes such as M15 or M5

- Maintaining proper risk settings

- Ensuring low latency execution

These elements help the EA operate without interruptions and benefit from accurate pricing.

Recommended Parameters for Best Results

- Trading pair: XAUUSD

- Platform: MetaTrader 5

- Timeframe: M15 or M5

- Recommended minimum deposit: 200 to 300 USD

- Suggested risk per trade: 1% to 2%

- Execution: ECN account preferred

These settings provide a balanced performance and enhance trade stability.

Advantages of Gold BO ATR EA V2.0 MT5

- Highly adaptive to different volatility levels

- Focuses on high-probability breakout opportunities

- Reduces emotional involvement in trading

- Safer than EAs that rely on doubling strategies

- Consistent decision-making through fixed rules

- Easy configuration suitable for all traders

- Well suited for both beginners and advanced users

Limitations of the EA

- Does not generate high-frequency trades

- Requires stable broker execution for best outcomes

- Works best when volatility aligns with breakout patterns

- Users must maintain consistent VPS connectivity

- Not designed for extreme-risk trading styles

Who Can Benefit from This EA

Gold BO ATR EA V2.0 MT5 is suitable for a wide range of traders, including:

- Beginners who need a structured gold strategy

- Intermediate traders looking to improve consistency

- Advanced traders who want to diversify automated systems

- Anyone who prefers disciplined, volatility-aware trading

The EA is not ideal for traders who expect quick profits or aggressive returns through high-risk techniques.

Final Summary

Gold BO ATR EA V2.0 MT5 delivers a structured, volatility-responsive approach to gold trading. By integrating breakout logic, pullback filtering, and ATR-based risk management, the EA creates a balanced trading system capable of navigating gold’s unpredictable movements. Its avoidance of martingale and grid methods adds reliability and long-term sustainability.

While no EA guarantees perfect results, this system offers traders a disciplined and organized framework for trading XAUUSD automatically. With proper setup, risk awareness, and realistic expectations, Gold BO ATR EA V2.0 MT5 can serve as a dependable addition to any automated trading environment.

For guidance, assistance, or community discussions, traders can connect here:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment